Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

It’s a big decision to purchase life insurance. There are a lot of factors to consider, and there is no time limit on making the decision. While this topic might be a bit overwhelming at first, especially if you’re just beginning your search for a policy that will fit your needs, we have some straightforward advice that can help make choosing much easier.

You might want to consider an online life insurance company like Everyday Life Insurance. Everyday Life Insurance is a newer company that offers a simple, no-nonsense approach to life insurance.

Every Life Insurance allows you to get life insurance quotes and apply for a policy online. Every Life Insurance will automatically update so that you are only paying for what you require once you purchase a life insurance policy from them.

Read on if this sounds like something you’d be interested in learning more about in our Everyday Life Insurance review.

Everyday Life Insurance is an online insurance concierge service that revolutionizes the process of obtaining life insurance for everyday people. The traditional process of getting the right life insurance was broken so they created a technology to make it easier, simpler, and more cost-effective to get individual advice and personal life insurance coverage.

Your unique circumstances shape your life insurance needs, and as circumstances change over time, your life insurance policy should automatically adjust as well.

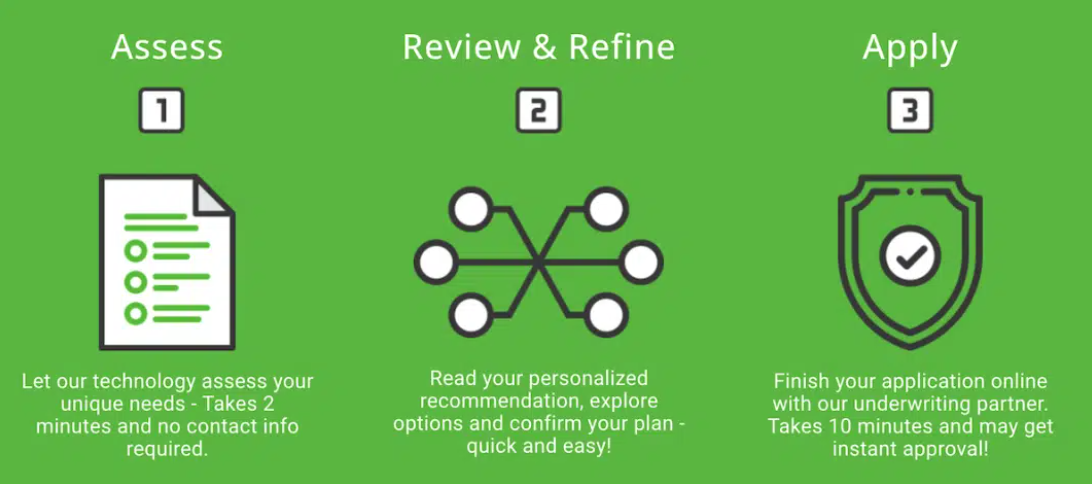

When you complete a free, simple 3-minute survey on the Everyday Life platform, your responses are combined with population data and analyzed using an algorithm.

This analysis then makes a personalized life insurance recommendation in a way that works for you. You are just one click away from purchasing this bespoke plan through our Everyday Life insurance partner.

By giving everyone access to free expert personal advice and low-cost life insurance, they’re making financial security more attainable than ever.

To learn more, visit the How It Works page or start with your own personal recommendations.

Everyday Life connects you with one of many insurance companies for your policy, such as Fidelity Life and Legal & General.

Fidelity Life specializes in insurance plans that don’t require proof and charge you based on your answers to a few questions about your health. Legal and General rates are the lowest offered in 70% of cases and in the top three lowest in 87% of cases, however, some may require a medical exam.

You can get Everyday Life coverage for $100,000 to $10 million. Your rates will be determined based on your health and age, as well as your financial condition, although Everyday Life offers policies for people ages 20-75.

It can be difficult to choose among the many available life insurance providers. Here are some of the differences between Everyday Life and the best life insurance companies.

Everyday Life tailors your coverage to fit your personal preferences, using predictive analytics to reduce costs. Your insurance will be higher if you have small children but will decrease as they get older to save money.

In most cases, purchasing life insurance through Everyday Life only takes a few minutes. You’ll start with a quote, and if the monthly payment works for you, move on to the time-consuming application process.

In most cases, you will not need to undergo a medical examination, but Everyday Life has the right to do so as part of your application.

Everyday Life coverage levels and rates are determined by a program called Predictive Protection. This measure adjusts your insurance based on events in your life, such as having children or approaching retirement age. Over time, your insurance goes up and down automatically.

While making our Everyday Life Insurance review, we found it an excellent choice as it recognizes how our lives change and evolve over the years.

Instead of the rate becoming stagnant, this company has cultivated a system that can move and adapt to the client’s needs. Customers can feel confident that Everyday Life Insurance will provide them with the best plan from some of the highest-ranking companies in the insurance industry.

The inclusive design allows every person to find the right plan for them. Everyday Life Insurance is excellent for everyone, but perfect for parents, individuals frequently switching jobs, or lower-income families due to the low rates.

Find out what type of coverage for term life or whole life insurance you can receive with us. Take charge of your future and allow our user-friendly insurance calculator to steer you to the plan best suited for you.

No more guesswork or long hours on the phone! Update your coverage with one of our many options. Be prepared for what is ahead.