Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Invest in commercial real estate for just $10

Fundrise is one of the pioneers of online real estate crowdfunding. Founded in 2010, the platform has seen some early success in this space, giving everyday investors access to real estate deals starting at $10.

But Fundrise isn’t the only real estate crowdfunding option on the market. And it’s very important to understand how your fee structure works and what the share redemption process looks like.

Our Fundrise review covers all the pros and cons, features, account types and liquidity issues of this platform so you can decide if it’s right for you.

Invest in commercial real estate online with eREITs and eFunds. Access real estate deals starting at just $10 and without being an accredited investor or paying expensive fees.

INVEST IN REAL ESTATE WITH FUNDRISE

Start Real Estate Investing With as Little as $10

Investing in commercial real estate can be a great way to grow your savings, but it’s not without risk.

The big risk. Commercial real estate requires a large amount of startup capital to acquire real estate. To properly diversify your portfolio, you need to own multiple properties, different types of properties (such as apartment complexes, shopping centers, offices, etc.) and properties in different locations.

However, for the small investor who wants to invest in commercial real estate, a REIT (real estate investment trust) is the way to go. Fortunately for investors, there is an online platform that can make investing in REITs easy.

It’s called Fundrise, and we think it’s one of the best real estate investment services on the market today. Let’s take a closer look to find out how it works, how you can use it, and whether it’s for you.

When you sign up for Fundrise, you can invest in your initial portfolio for as little as $10. Alternatively, Fundrise offers four different portfolio plans that have minimal investment minimums and give you more control over the types of investments.

Whatever you choose, Fundrise invests your money in a variety of eREITs and eFunds comprised of private real estate assets held in the U.S. Fundrise will customize your specific allocation based on your personal investment needs.

Although your results will vary depending on your plan, Fundrise pays investors in two ways:

Got $10? Start Investing In Real Estate With Fundrise

Fundrise as a platform has changed significantly since its inception. Investors these days have much more control over the types of investment accounts they use and their overall portfolio strategy.

Some of Fundrise’s main features include:

Fundrise only requires a minimum initial investment of $10. This amount gives you the service’s initial portfolio, a diversified mix of eREITS and eFunds with major US-based real estate projects. You receive income through quarterly dividends as well as appreciation of your shares.

With a $1,000 investment, you upgrade to a basic portfolio that unlocks Fundrise retirement accounts, investment goal planning, and access to Fundrise iPO. And if you invest $5,000, you upgrade to a basic portfolio that lets you choose different investment plans to meet your goals.

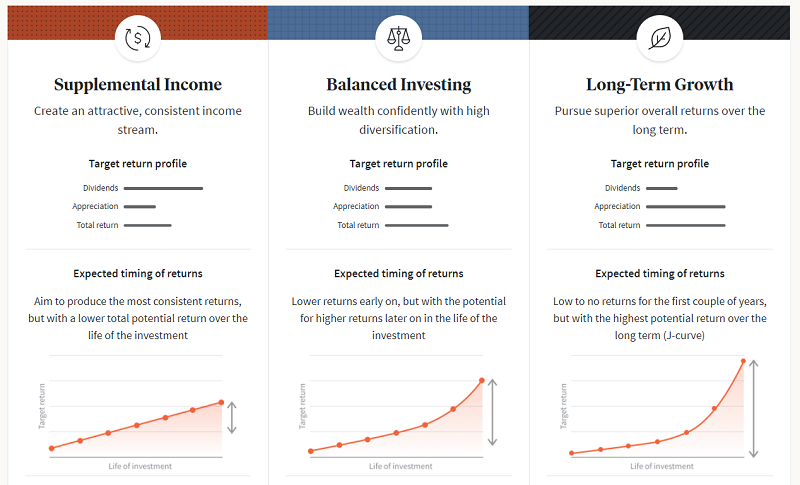

Different investing plans Fundrise offers include:

If you’re not sure which is right for you, Fundrise offers a three-step quiz that can help you decide how to invest.

You can also compare all the different Fundrise account levels and benefits to decide which plan is right for you.

| Starter | Basic | Core | Advanced | Premium | |

|---|---|---|---|---|---|

| Minimum Investment | $10 | $1,000 | $5,000 | $10,000 | $100,000 |

| Standard Plans | No | No | Yes | Yes | Yes |

| Plus Plans | No | No | Yes | Yes | Yes |

| Potential iPO Access | No | Yes | Yes | Yes | Yes |

| Auto-Invest Option | Yes | Yes | Yes | Yes | Yes |

| Investor Goals | Limited | Yes | Yes | Yes | Yes |

| Direct Investment Into Open Funds | No | No | Yes | Yes | Yes |

But the fact that it only takes $10 to start investing in income-generating real estate is one of Fundrise’s key strengths. And after investing $5,000, you have more control over the types of investment programs you use.

Fundrise publishes historical performance reports annually as well as quarterly reports. It has had 21 positive quarters and zero negative quarters to date, with the worst quarter returning 1.15% and the best quarter returning 9.40% for investors.

Here’s how Fundrise’s performance compares to public REITs and the S&P 500:

| Fundrise | Public U.S. REITs | S&P 500 | |

|---|---|---|---|

| 2022 Q1 | 3.49% | -5.27% | -4.60% |

| 2021 | 22.99% | 39.88% | 28.71% |

| 2020 | 7.31% | -5.86% | 18.40% |

| 2019 | 9.16% | 28.07% | 31.49% |

| 2018 | 8.81% | -4.10% | -4.38% |

| 2017 | 10.63% | 9.27% | 21.83% |

As you can see, both US public REITs and the S&P 500 have had quarters of higher returns. But they’ve also had worse quarters than Fundrise, so there’s more volatility.

That said, always remember that past performance is no guarantee of future performance.

Got $10? Start Investing In Real Estate With Fundrise

Fundrise charges an annual asset management fee of 0.85%, in addition to an advisory fee of 0.15%. They are up to 1.0% per year. You also don’t pay any transaction fees or sales commissions.

However, the company may charge other miscellaneous fees, such as development or settlement fees, which can add up to 2%. But for many long-term investors, Fundrise only pays a 1% annual fee.

When it comes to investing in real estate, liquidation is an important factor to consider. After all, real estate is less liquid than investing in stocks, ETFs, or even cryptocurrencies in most cases.

Fortunately, Fundrise has made some positive changes to make its stock more liquid. For eREITS and Fundrise eFund, you can request full or partial redemption of shares without paying penalties if you have held shares for 5 years or more. For shares less than 5 years old, you pay a 1% penalty.

With respect to Real Estate Fund and Fundrise Income Real Estate Fund, there is a quarterly liquidation window in the form of quarterly redemption offers that do not carry penalties.

Overall, Fundrise is a long-term investment due to the 5-year penalty-free requirement. And just remember that stocks aren’t as liquid as other assets like stocks and ETFs.

Very few investments can be considered truly “safe,” that is, with guaranteed returns. However, less liquid real estate investments tend to provide better protection against downturns in the broader market than securities such as stocks and mutual funds.

And Fundrise’s eREIT and eFund portfolios are as secure as anything you’ll find in the real estate space.

Unlisted REITs and eREITs are registered investments and, while they are subject to the same SEC requirements that a publicly traded REIT must meet, they are not directly linked to stock market fluctuations. Two disadvantages. there isn’t the same liquidity because they aren’t traded on the markets, and the upfront fees are higher than exchange-traded REITs.

| Type | EREITs | Non-Traded REITs | Exchange-Traded REITs |

|---|---|---|---|

| Publicly Traded | No | No | Yes |

| Secondary Market | No | Typically No | Yes |

| Front-End Fees | None | 0-15% | 0-7% + broker commission |

The minimum investment is just $10 for Fundrise eREITs, and you don’t have to be an accredited investor to participate. Shares in eREITs are purchased exclusively online, and Fundrise members receive notifications when new assets are added to eREITs.

Fundrise is a legitimate real estate investment platform and is registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940.

It also has low investment requirement and great experience. However, Fundrise correctly discloses that past performance is no guarantee of future results or expected returns.

Fundrise is one of the best real estate investment platforms with a minimum investment of $10. Few platforms offer such a beginner-friendly way to invest in real estate. And with its positive track record and variety of investment programs and funds, Fundrise has a lot going for it.

That said, some Fundrise alternatives like RealtyMogul and Streitwise can outperform Fundrise depending on your investment goals and initial investment size.

| Highlights |  |

|

|

| Rating | 9/10 | 9/10 | 7/10 |

| Minimum Investment | $10 | $5,000 | $5,000 |

| Account Fees | 1%/year | 1-1.25%/year asset management fee | 2% annual management fee |

| Private REIT |

|

|

|

RealtyMogul has similar fees to Fundrise. But one key difference is that many equity investments have a target holding period of three to five years, which is shorter than Fundrise’s. The $5,000 investment minimum is much higher, but RealtyMogul focuses on investing in cash-flow generating real estate and offers REITs and 1031 exchanges.

As for Streitwise, it pays 2% per year, which is higher than Fundrise. But Streitwise focuses on providing consistent dividend income. According to its website, Streitwise has achieved annualized returns of 8% or more since 2017.

Overall, Fundrise is a comprehensive and beginner-friendly option for investing in real estate. And the fact that you can choose investment goals with their Basic plan is a plus. But don’t be afraid to consider some alternatives if you want more investment choices or dividend income.

Real estate as an asset class is a long-term investment. This includes REITs, whether they are publicly traded REITs, unlisted REITs or eREITs. Opportunities for capital appreciation, portfolio diversification and regular distribution are attractive; however, distributions are never guaranteed.

While not the same as investing directly in real estate, REITs are much more passive and allow you to invest in properties outside of your geographic location. Crowdfunding can be a way to diversify into real estate without the huge capital or administrative headaches involved in doing it yourself.

Although I am a real estate investor, REITs have never appealed to me for a number of reasons, mainly the up front load and ongoing fees. Fundrise eliminates investment fees with its 0.85% asset management fee.

And the fact that Fundrise only costs $10 to get started makes it a great way for investors to dive into real estate investing.

Get Started With Fundrise Today

By pooling the funds of many individual investors, the REIT can purchase a diversified mix of commercial properties — such as office buildings, shopping centers, hotels, and apartments — that the typical investor might not otherwise be able to purchase individually. One type of REIT, an exchange-traded REIT, is available through any broker; as the name implies, its shares trade on the securities markets. Exchange-traded REITs have a few downsides, however. For one thing, their performance is heavily correlated with the broader stock market.

Fundrise’s eREITs are most similar to non-traded REITs. The primary difference is in the fees. When you invest in an eREIT, you don’t go through a broker — you buy directly from Fundrise. That allows Fundrise to reduce the fees dramatically. There’s no middleman, so there are no upfront fees or commissions. And rather than paying a front-end load of 7%–15%, Fundrise charges just a 1.0% annual asset management fee.

An eFund (short for Electronic Fund) invests in commercial real estate and is exclusive to Fundrise. It’s similar in design to a professionally managed mutual fund, but like the eREITs not publicly traded. eFunds are set up as partnerships and not corporations, so they are taxed differently — saving on double taxation, also, like eREITs Fundrise offers these eFunds to investors without any brokers or commissions. Unlike an eREIT which is typically used for income, Fundrise’s eFunds are set up for growth.

| Minimum Investment | $10 |

| Account Fees | 1%/year |

| Time Commitment | 0 Months |

| Accreditation Required |

NO

|

| Private REIT |

|

| Offering Types | Debt, Equity, Preferred Equity, Direct Ownership |

| Property Types | Commerical, Residential, Single Family, Foreign Investors |

| Regions Served | 50 States |

| Secondary Market |

YES

|

| Self-Directed IRA |

YES

|

| 1031 Exchange |

NO

|

| Pre-vetted |

YES

|

| Pre-funded |