Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

CrowdStreet is a real estate crowdfunding platform that also offers accredited investors access to real estate deals. However, its high minimum investment can make it prohibitive.

| Minimum Investment | $25,000 |

| Account Fees | None |

| Time Commitment | 36 Months |

| Accreditation Required |

|

| Private REIT |

|

| Offering Types | Debt, Equity, Preferred Equity, Direct Ownership |

| Property Types | Commerical, Residential, Single Family, Foreign Investors |

| Regions Served | 50 States |

| Secondary Market |

No

|

| Self-Directed IRA |

yes

|

| 1031 Exchange |

yes

|

| Pre-vetted |

yes

|

| Pre-funded | No |

Direct sponsor investment — CrowdStreet is one of two major marketplaces that operate under a direct-to-investor model, where investors can invest directly with a sponsor rather than through a special purpose vehicle. A direct-to-investor model can result in lower overall risk for the investor.

The most popular method of CrowdStreet investing is to invest in individual deals through its marketplace.

The company connects sponsors (real estate operators and developers) with investors who want to participate in commercial real estate. But there are really three main ways to invest with CrowdStreet that can suit different investment goals.

CrowdStreet’s most popular investment method is to invest in individual transactions through its marketplace.

The marketplace is where sponsors can list their commercial real estate projects under development for investors to consider. CrowdStreet charges backers in exchange for listing them on the marketplace and helping them raise capital. In turn, investors can directly invest in the sponsors and real estate projects they want in their portfolios.

You will find a variety of offers on the CrowdStreet marketplace. Offers generally have a minimum holding period of two to ten years and have a minimum investment requirement of $25,000. However, minimum investment requirements may be as high as $100,000 or more for some offers.

You can also use filters to find offers with different loan-to-value percentages and distribution periods (monthly, quarterly, semi-annually or annually).

The offers also contain information about the property, cash flow, neighboring areas and sponsor details to help you with your due diligence.

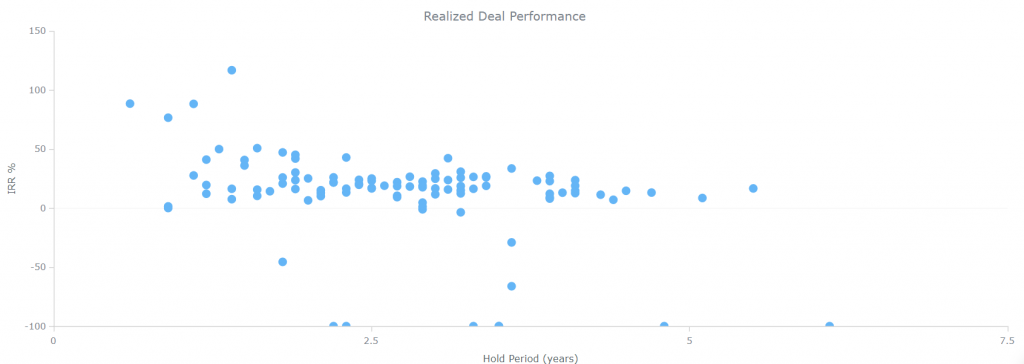

To date, more than $3.16 billion has been invested in 629 deals, generating more than $591 million in distributions. And what really sets CrowdStreet apart from many competitors is their sponsor selection process. The CrowdStreet team evaluates patrons’ history and assigns them the appropriate designation;

According to their website, about 2% of applicants are approved. Once approved, deals go live on the market and can follow a variety of investment structures such as equity or mezzanine debt, although most deals are equity-based.

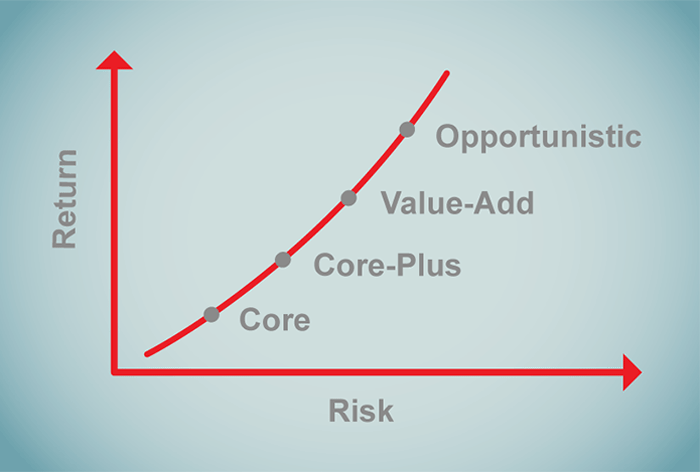

Finally, CrowdStreet assigns an investment profile to trades to help investors find the right trade for their investment goals;

Finally, the CrowdStreet marketplace has a wide variety of commercial real estate deals. And you can filter by different risk tolerance levels to find the projects you feel comfortable with.

Finally, the CrowdStreet marketplace has a wide variety of commercial real estate deals. And you can filter by different risk tolerance levels to find the projects you feel comfortable with.

The CrowdStreet marketplace primarily offers one-to-one transactions. It sometimes lists multiple funds, but has historically focused on individual transactions between investors and sponsors.

However, CrowdStreet is getting into the REIT game like other crowdfunding platforms. With the launch of CrowdStreet REIT I or C-REIT, you can invest in a portfolio of growth-oriented private commercial real estate projects.

This C-REIT has 20-25 transactions and requires a minimum investment of $25,000. If you want more diversification and don’t have time to do due diligence on dozens of individual market transactions, this is the perfect solution.

This REIT has a target holding period of five to seven years and includes projects in different regions and from different sponsors.

A third way to invest with CrowdStreet is to work with an advisor to build a personalized commercial real estate portfolio.

This service is provided by CrowdStreet Advisors LLC, a subsidiary of CrowdStreet. You need a minimum balance of $250,000 and account fees vary based on investment size.

Work with an advisor and start by calling to discuss your investment goals and risk tolerance. From there, your advisor selects trades that meet these goals and allocates your funds. If you are serious about investing and want advice and ongoing portfolio management, this is for you as long as the fees match your portfolio.

Investments in the CrowdStreet marketplace are generally only available to accredited investors and have a minimum of $25,000.

To become an accredited investor, you must have more than $1 million in net worth alone or with a spouse. Alternatively, you must have self-employment income that exceeds $200,000 in each of the previous two years, or $300,000 in jointly earned income with your spouse.

However, CrowdStreet is making its marketplace more accessible. Today, investors can apply filters to search for market opportunities that are also available to non-accredited investors. Sometimes you can also find investments with a minimum investment requirement of $10,000 or less.

In the past, CrowdStreet has partnered with various companies to offer REITs and other investment offerings to non-accredited investors. These offerings are unusual, but it’s clear that CrowdStreet is working to diversify its market offerings with its new C-REIT.

CrowdStreet sponsors generally have target retention periods of three to five years. However, some CrowdStreet contracts have retention goals of up to 10 years.

You cannot sell your CrowdStreet investment before the end of the holding period, as you can with stocks or ETFS. This lack of liquidity is one of the drawbacks of CrowdStreet and real estate investing in general. In short, treat CrowdStreet as a mid- to long-term investment.

It’s worth noting that some crowdfunding companies like Fundrise have secondary markets where you can sell your shares, so liquidity concerns aren’t as high.

Through technology, crowdfunding real estate companies offer features and benefits not previously available to mainstream investors, including:

Diversification — Instead of investing $100,000 in one property and waiting for it to mature, investors can now choose to invest $10,000 in ten different deals that vary by geographic region, sponsor, investment structure, asset class, risk profiles and holding periods.

If you’re looking to add commercial real estate to your portfolio and aren’t afraid to do your own due diligence, CrowdStreet is worth considering.

To date, the platform has funded more than 629 deals with $3.16 billion invested and $591 million distributed. It also has an internal rate of return (IRR) of 18.3%, and you can view a list of transaction performance history on the CrowdStreet website.

However, CrowdStreet correctly points out on its website that the potential returns in commercial real estate are heavily influenced by risk. For example, CrowdStreet has safer but less profitable primary offerings that provide predictable cash flow. But you also have opportunistic trades and value-added trades that have higher potential returns but carry greater risks.

Ultimately, you should determine your risk tolerance level, return goals, and carefully research CrowdStreet’s investment opportunities. CrowdStreet has a promising track record and can be a good investment, but you should always do your own due diligence as well.

CrowdStreet does not charge any fees to investors, which is the advantage of this real estate investment platform. However, sponsors may charge fees for providing investment opportunities.

There are a number of potential sponsor fees, and CrowdStreet provides more details on potential fees on its website. Fees typically range from 2% to 5% and also vary by project.

However, the lack of direct fees for investors is CrowdStreet’s advantage over many crowdfunding platforms.

CrowdStreet is a great platform to access verified commercial real estate opportunities. But with a minimum investment requirement of $25,000 for most projects, it’s not very beginner-friendly. And until more regular opportunities for non-accredited investors emerge, the accreditation requirement is another potential hurdle.

However, there are many CrowdStreet alternatives you can use to add real estate to your portfolio.

| Highlights |  |

|

|

| Rating | 9/10 | 8/10 | 9/10 |

| Minimum Investment | $10 | $25,000 | $5,000 |

| Account Fees | 1%/year | None | 1-1.25%/year asset management fee |

| Private REIT |

yes

|

yes

|

yes

|

Fundrise is the best alternative for investing in real estate with little money because it has a minimum funding of $10 and is open to non-accredited investors.

As for RealtyMogul, it is another reputable commercial real estate investment platform for accredited and non-accredited investors. And their $5,000 minimum investment is significantly lower than CrowdStreet.

CrowdStreet remains a great option for accredited investors who want to do their own research. But definitely consider other real estate investment opportunities, especially if you want a lower investment minimum.

No Direct Fees – CrowdStreet does not charge fees directly to investors.

Only Commercial Real Estate – Unlike other marketplaces that mix single-family home fix-ups and conversions with commercial real estate deals, CrowdStreet is 100% focused on the commercial real estate market, and that shows in the quality of the investment deals available on the site. :

Deal Access – Access to transactions that investors would otherwise be unaware of or unable to invest in.

Easy to Compare Opportunities – CrowdStreet puts all your proposal information and documents in the same format. This makes it easy for investors to compare and contrast multiple offers that meet their investment criteria.

Dashboard Tools – A key feature of online crowdfunding platforms is the use of technology to make real estate investing more efficient, transparent and scalable through online dashboard tools. CrowdStreet is continually improving its dashboard to include useful deal comparison and forecasting tools. Its latest iteration includes a comprehensive portfolio analysis.

High Minimum Investment –CrowdStreet has a minimum investment requirement of $25,000 for most offerings, which is on the higher end. For many other real estate crowdfunding sites, the minimum per transaction is only $5,000, with some even as low as $10, like Fundrise.

No Liquidity – Like most real estate investing and crowdfunding platforms, once you invest, you are pretty much committed to the investment for a period of time. There is currently no secondary market to sell your investments to others.

In any market, when it comes to efficiency, scalability and choice, consumers often win. As the online real estate investment market continues to grow, the quality of investment options and terms available will likely continue to improve as more investors enter online markets and more sponsors enter and compete to attract them.

The bottom line is that CrowdStreet offers access to a large volume of vetted commercial real estate transactions, both equity and debt, and does not charge investors direct fees. If you meet the accreditation requirements and funding minimums, it’s a great platform to invest in.

And for non-accredited investors or novice investors, you can still invest in real estate with more beginner-friendly options like Fundrise.

CrowdStreet is a legitimate company that has a thorough vetting process for the investment opportunities it provides access to. The company is also SEC compliant and restricts most investments to accredited investors.

What is CrowdStreet’s minimum investment?

Most CrowdStreet investments are a minimum of $25,000. The market is slowly expanding its offerings, and users can now search for opportunities with a minimum of $10,000, which are also open to non-accredited investors. But most investments require $25,000 or more.

CrowdStreet makes money in a few different ways. The first source of revenue is selling software subscriptions to sponsors to help them manage transactions and investors. CrowdStreet also collects sponsor fees in exchange for helping raise capital through its marketplace. According to CrowdStreet, “CrowdStreet does not charge investors direct fees for these two methods. However, since investing in real estate with investors is the sponsor’s primary income-generating activity, these fees are ultimately built into the agreement.”