Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt USD866267322 ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.realm real estate

When it comes to investing in real estate, you have many options. For some investors, buying a rental property is a way to get into the market. For others, REITs or crowdfunding platforms are the preferred solution.everydaylife insurance

However, strategies such as leasing require a large amount of start-up capital. And if you become a landlord, you are definitely not looking for a passive investment because you have to manage tenants.tortax hussain

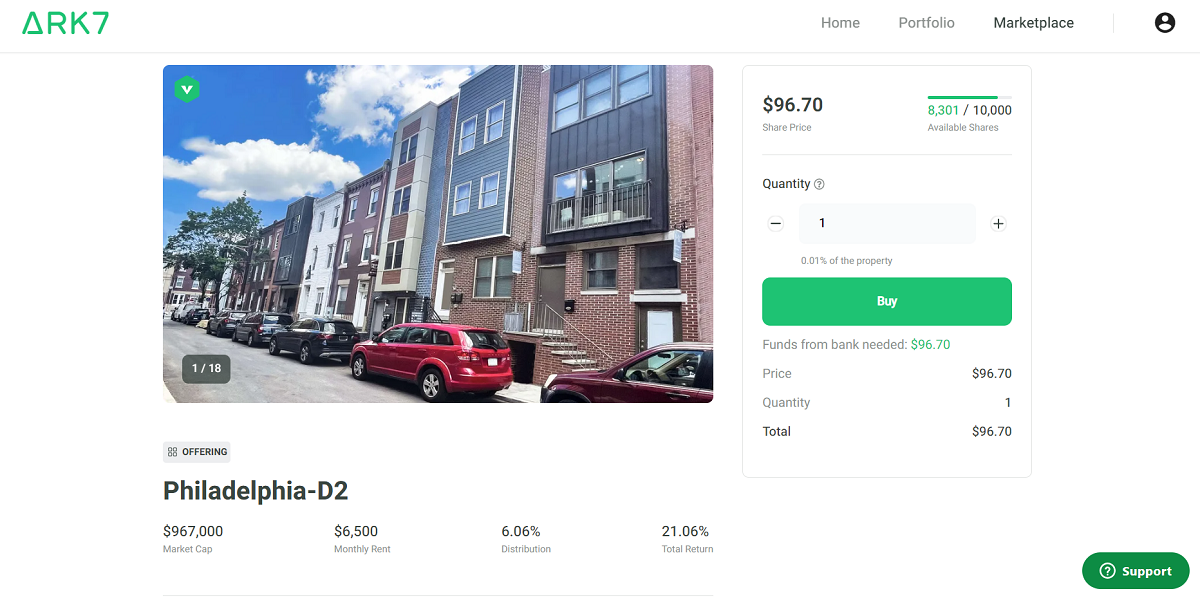

Ark7, a newer fractional real estate company, is changing this model. It allows accredited investors to buy shares in profitable rental properties and is completely passive. But it may not be the best option compared to some crowdfunding options out there. Our Ark7 review details how this platform works and whether it’s worth using.

Ark7 allows accredited investors to purchase single and multi-family rental units. Its low minimum investment requirement is a selling point, although the platform has fewer offerings than some of the larger companies in the space.

Ark7 Logo Founded in 2018, Ark7 is a fractional real estate investment platform that allows accredited investors to buy shares in rental properties. The company offers a simple way to add real estate to your portfolio without buying an entire rental property or investing in REITs. And with stocks starting at around $35, you don’t need a lot of capital to get started.

According to its website, Ark7 has already grown to more than 6,000 investors and has seen more than $13 million in property value funded through the platform. It has also paid investors $860,000 in distributions so far. These distributions are Ark7’s main draw, with investors receiving monthly distributions paid out of the property’s rental income.

Ark7 is similar to companies such as Arrived Homes and Landa, which allow you to buy shares in income-generating rentals. With Ark7, you invest in individual property, not equity funds like many crowdfunding sites offer. This means it requires more transaction-by-transaction and getting started with Ark7 is very simple.

You create an Ark7 account using your email or Google Account. From there, you can search for open deals on the Ark7 website or with their new mobile app.

At the time of writing, there are 14 properties available for investment. Properties include single family homes, townhomes and townhomes. Each list includes a breakdown of:

Ark7 provides a financial summary, outlining revenues and expenses, as well as a look under the hood. There’s also a “proceeds use” section that explains where all the money Ark7 raises goes.

Ark7 currently has properties in six markets and is expanding in the United States. It searches for rental properties in high-growth markets and typically owns between 1% and 10% of the properties it lists. This means that Ark7 has a stake in the game along with investors, which is a good thing.

When you buy Ark7 property shares, you are looking at a completely passive investment. This is because Ark7 manages tenants on its own or with various third-party property management companies. In some cases, Ark7 uses some of the capital it raises to renovate and upgrade units to charge a higher rent. But let me say again that it is not your responsibility and you are a passive shareholder.

To buy shares, you link your checking account to your Ark7 account and enter the number of shares you want to buy. The advantage of Ark7 is that shares typically range from $35 to $100 per share. This allows you to invest in real estate without a lot of money. And now you can open a traditional or Roth IRA through a partnership with the Millennium Trust Company.

Once you own the shares, you receive monthly payments of cash distributions from the rental income. According to their website, investors earn approximately 6% in distributions annually. At the moment you can’t automatically flip distributions, but this feature is not coming yet. And you can always buy more shares as soon as you get your distribution.

You must hold your Ark7 shares for at least one year, unless otherwise specified in the contract. You can then redeem your shares to exit. However, Ark7 has two types of redemption payments depending on how long you hold the shares:

This is a bit confusing, but essentially means you have to wait 24 months to exit if you want to get the most value for your shares. There is currently no secondary market to sell to other investors, although Ark7 says it is in development.

Ark7 charges a one-time origination fee of 3% for buying and listing properties on its platform. He also takes 8% to 15% of the rental income in exchange for managing the property and the tenants. Additionally, Ark7 may charge between 0.5 and 1 month’s rent when applying for vacancies.

Prices are higher than competitors such as Arrived Homes. And if you compare Ark7 to Crowdfunding sites like Fundrise, which charge 1% per year, you’re clearly paying more. But this is in exchange for property management of the rental unit, which generates monthly cash payments.

Investors can earn with Ark7 through monthly distributions and possible stock appreciation. And as of July 2022, Ark7 has seen average annual distributions of 6% of monthly rental income.

This does not take into account the potential appreciation of the property, although many of the open offers are too recent to be appraised. After all, this is a newer player in the real estate investment space, so we need a few more years to see the full picture in terms of performance.

You can sell your Ark7 shares after a year, but you have to wait 24 months to sell them for full value. There is also no secondary market, which is a disadvantage. This makes the Ark7 an illiquid investment, so it’s not ideal if you’re investing for the short term and need flexibility.

Ark7 is a secure investment platform that takes several steps to protect investors. For starters, each property is owned by its own LLC. This protects shareholders from being sued by tenants and other potential property issues. This is a must for fractional real estate companies and limiting your liability is a green flag.

In terms of personal security, Ark7 encrypts data with the same security protocols used by banks and other FinTech companies.

Just remember that your investments are not FDIC or SIPC insured like you are with an online broker because they are real estate. And Ark7 does not guarantee returns. Risks such as tenant absenteeism, late payments, and property wear and tear are all risks that you should be aware of.

You can contact Ark7 Customer Support by email at support@ark7.com or by calling 1-415-275-0701. Phone support is available Monday through Sunday from 8am to 8pm PDT. There is also an in-person option to chat with Ark7 support that you can schedule on their website.

With its low minimum investment and easy-to-use platform, Ark7 makes investing in rental units easy. And the fact that you pay monthly cash distributions is a selling point.

However, this real estate investment platform continues to grow. And the fact that it’s only open to accredited investors is a downside. If you want to invest in real estate with some companies with a longer history, there are several alternatives worth considering:

| Highlights |  |

|

|

| Rating | 9/10 | 8/10 | 9/10 |

| Minimum Investment | $10 | $25,000 | $5,000 |

| Account Fees | 1%/year | None | 1-1.25%/year asset management fee |

| Private REIT |

YES

|

YES

|

YES

|

Fundrise is our overall favorite choice because of the $10 minimum investment and lack of accreditation requirements. It also has a secondary market to sell shares unlike Ark7 and charges lower fees.

CrowdStreet and RealtyMogul are also great alternatives if you want to invest in individual businesses or real estate funds. Minimum investment requirements are much higher, but both companies have longer histories and more open offerings.

Recent years have seen a boom in real estate crowdfunding companies and fractional investment platforms. This is always good news for investors, as more competition usually means better services and lower fees.

That said, Ark7 is a new venture in a very crowded field. We like its low share prices and the fact that it receives monthly payments for rental units. However, like many newbies in the space, it doesn’t have a very long history and is still expanding into new markets.

If you are an accredited investor, you can enter Ark7 if you want your portfolio to include income-producing real estate. But non-accredited real estate investors are better off with companies like Fundrise or investing in real estate through REITs and ETFs.