Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Ensure a loved one has additional monthly income after age 91 with a simple monthly payment. AgeUp offers a new type of deferred income annuity that provides financial protection beyond age 90.

“One in five American adults have nothing saved for retirement,” Forbes wrote in a 2019 article on the retirement crisis. While there is debate about the exact nature of the retirement crisis, many Americans are concerned about how to pay for retirement.

It’s not just the older generations, both Generation X and Y are worried about how their parents and other loved ones will handle retirement. As more Americans live longer, the possibility of outgrowing retirement savings increases.

In a 2019 article, AARP predicted that Social Security benefits would run out by 2035. Social Security benefits are a lifeline for many Americans.

If the system is not changed, the background will be blank. A new, first-of-its-kind product called AgeUp has been introduced to fill the retirement gap.

AgeUp is an advanced deferred annuity. This is the insurance world’s way of saying that you can make a monthly payment now to guarantee your loved one’s future income when they turn 91.

This is what an annuity is. pay a fixed monthly amount now to deposit future income. Monthly rates range from $25 to $250 and must begin when the loved one is between 50 and 75 years old.

AgeUp is unique because it is the first annuity to supplement retirees after age 90 and can pay from $100 to $6,000 or more per month. AgeUp is not a new company, but a product created by Haven Life Insurance, the same company that brought you Haven Life Term Insurance.

Haven Life and AgeUp are underwritten by MassMutual – Massachusetts Mutual Life Insurance, Haven Life’s parent company.

QUICK SUMMARY

Product: Deferred Income Annuity

Premium: Starts at just $25/month

Promotion: No current promos

AgeUp has just launched a unique offering on the market: a deferred annuity. An annuity is a product where customers buy blocks of guaranteed future income today with payments at fixed intervals.

A fee is paid each month (called a premium) and a guaranteed monthly return is paid on a certain date for the duration of the annuity. This monthly statement can be used for supplemental income, health insurance and many other things.

With AgeUp, this income is a deferred annuity. What makes it unique is that it is the first annuity offered to help people who may not have enough money for retirement.

AgeUp is specifically aimed at people over the age of 91 who want extra income for those golden years. Customers pay a monthly premium and after age 91, the insured will receive a fixed monthly income.

AgeUp calls the monthly premium payment “cumulative” and each “cumulative” receives a guaranteed additional “slice” of future income.

Depending on the monthly premiums, the adult child you purchased could receive between $100 and $6,000 a month after the parents turn 91.

You may be interested. Who is AgeUp and how do I know they will still be around in 20 years or so when my loved ones turn 90? A big question.

AgeUp Annuities are underwritten by MassMutual, a leading mutual life insurance company and insurance giant with over 160 years of underwriting history. MassMutual is a Fortune 100 company with an A++ financial strength rating.

In short, you can be sure that the monthly payments are secure in the future and any financial risk is minimal.

AgeUp is not a company, but a financial product startup offered by the insurance savvy kids behind Haven Life. You’ve probably read my Haven Life review (check it out).

Haven Life Insurance Agency is the in-house fintech startup of insurance giant MassMutual. Since its inception, Haven Life has been a life insurance company with a mission to reinvent term life insurance through technological wizardry.

In 2018, Haven Life acquired Quilt, which successfully used technology to make renters insurance available online and at a lower cost. Quilt was an overnight success, quickly leading to Haven Life acquiring an undisclosed amount.

Together with Haven Life, the Quilt team began thinking about the next digital disruption in the insurance market.

Taking a page from the MassMutual playbook, AgeUp is a startup within a Haven Life startup, which was a startup within MassMutual. Quilt CEO and co-founder Blair Baldwin leads AgeUp’s Boston team.

AgeUp grew out of conversations with Haven Life clients in 2018 and early 2019. With life expectancy increasing and the overall level of household savings increasing, people have become increasingly concerned about how to fund retirement well into their 90s.

The company faced a growing problem. How to help people plan for when loved ones outgrow their savings? America is facing a retirement gap, and more people than ever are living into their 90s.

AgeUp is an advanced living deferred annuity purchased by people aged 21 to 75 for a loved one who is now aged 50 to 75. After your loved one turns 90, he or she is eligible to receive additional monthly income payments from the annuity. .

These payments will depend on how much is paid into the annuity, for how long and the repayment options chosen (more on this below).

Every payment made into an annuity contract is guaranteed future income, even if the contract expires. This means that you do not cancel the annuity contract, although you can stop paying the contract.

Beginning in 2o22, AgeUp is available nationwide, except in California, Florida and New York. However, California is reportedly “coming soon” as of this writing, so it’s worth checking out the company’s FAQ if your state is currently covered.

AgeUp has the following age restrictions on who can buy an annuity contract (buyer) and who can receive an annuity contract (annuitant).

Remember that the owner of the annuity contract (the annuitant) cannot receive payments from the annuity contract until age 91.

Payments under an annuity contract continue until the beneficiary reaches the payment age selected for up to 13 months.

AgeUp offers its annuity for those who are at or near retirement age, who are in reasonably good health, and who threaten their financial resources after age 90.

For example, at a minimum, a buyer must make monthly payments on an annuity contract for just under 15 years, or about 179 months. This assumes that the retiree was 74 years old, was about to turn 75, and started receiving payments shortly after turning 91.

There are four additional qualifications:

AgeUp charges a monthly fee for those who purchase an annuity contract. This monthly cost ranges from $25 to $250.

The monthly payment will directly affect how much money is in the annuity contract when it comes time to receive payments. The death before maturity option also affects the value.

As it sounds, this is a guarantee that the annuity will be paid unless your loved one turns 91 (or any selected age between 91 and 100).

This is a small insurance policy that protects the value of the amount paid into the annuity. To better understand costs, we ran several different cost and payment tests.

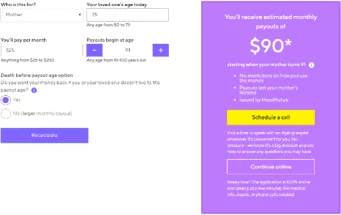

In this example, we want to buy an annuity contract for our mother. At the moment, he is the maximum age allowed by the policy – 75 years.

Our mother is in relatively good health, has retirement income from a former employer, and has reasonable savings. We want to buy a small annuity in case she needs a little extra income in her 90s, maybe to help with household bills.

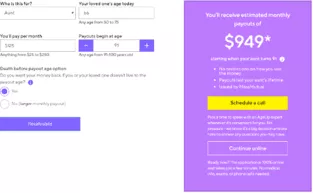

In this example, we want to buy a much larger monthly payment for our aunt. Although he is well and has saved well for retirement, health issues are starting to run in the family.

We want to make sure you have plenty of extra income to get you through those last few years no matter what.

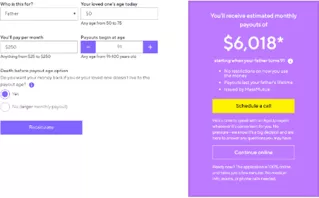

In this example, our father needs a guarantee that he will have enough income for his 90th birthday. He has owned his business for the past 20 years, but has fallen on hard times since the financial crisis.

Although the business is looking much better, we cannot count on the income from the business to support him in retirement.

If you’re ready to buy an AgeUp deferred annuity for a loved one, you’ll want to head over to the website. Make sure you’ve confirmed that AgeUp is available in your state and that you’re ready to apply for a loved one.

You can start with an online quote, or if you need someone to talk to, you can call, email or use online chat. After completing the online quote, you will be prompted to complete the application online or over the phone.

There is no medical supervision and the application should take 5 to 10 minutes. You will need a phone number to start registration.

The application has five sections:

After completing the application, you will likely receive a confirmation within a few minutes.

First of all, we love this idea. This helps solve a serious problem: running out of money for retirement. With people living longer and the cost of living in the US rising, this is a good backup option.

For many, this will be a major purchase for family and friends who may not have enough for 30 or more years to retire.

There are two major drawbacks here: a new, unproven product and a relatively new company, Haven Life.

It’s great that MassMutual supports this product, but what if MassMutual doesn’t exist in 20 or 30 years, when AgeUp is most needed?

What happens to transfer fees or additional costs if Haven Life or AgeUp goes out of business? Also, as a new product, it works.

It will take a minimum of 15 years to see a return on AgeUp annuities. Make sure you weigh the pros and cons before you buy. We think it’s a good buy, but it’s not for everyone.

Guarantee a loved one has supplemental monthly income after age 91 for a simple monthly fee. AgeUp is a new type of deferred income annuity that provides financial protection after the age of 90.